This year's Budget was announced this morning by Treasury Minister Dr Alex Allinson, we've broken it down so you can understand if and how it affects you..

2023 budget at a glance:

- The income tax personal allowance will remain at £14,500 for a resident individual and £29,000 for a jointly assessed couple.

-

For higher earners, the personal allowance will be tapered and reduced by £1 for every £2 that a person’s total income is above £100,000 (£200,000 for jointly assessed couples). This means if a person’s total income is £129,000 (£258,000 for jointly assessed couples) or above their personal allowance will be zero.

-

The income tax lower rate for individuals remains at 10% and the higher rate at 20%. The threshold at which the higher rate of income tax becomes payable remains at £6,500 for an individual and £13,000 for a jointly assessed couple.

The first £600 of any general benefits in kind, provided to an employee by an employer, will be exempt from income tax. Only the amount above £600 will now be taxable. This will not apply in respect of accommodation and associated expenses. The treatment of bicycles, cars and fuel remains unaffected.

The National Insurance Holiday Scheme is amended as follows from 6 April 2023:

-

The maximum value of a refund is increasing from £4,000 to £4,400

-

The minimum annual gross salary which must be earned in order to qualify for a refund is increasing from £21,000 to £23,000

- The requirement to work a minimum number of hours to qualify for a refund is being removed

The National Insurance thresholds and upper earnings limit will be increased by 5%. Class 2 and Class 3 rates will be increased accordingly.

-

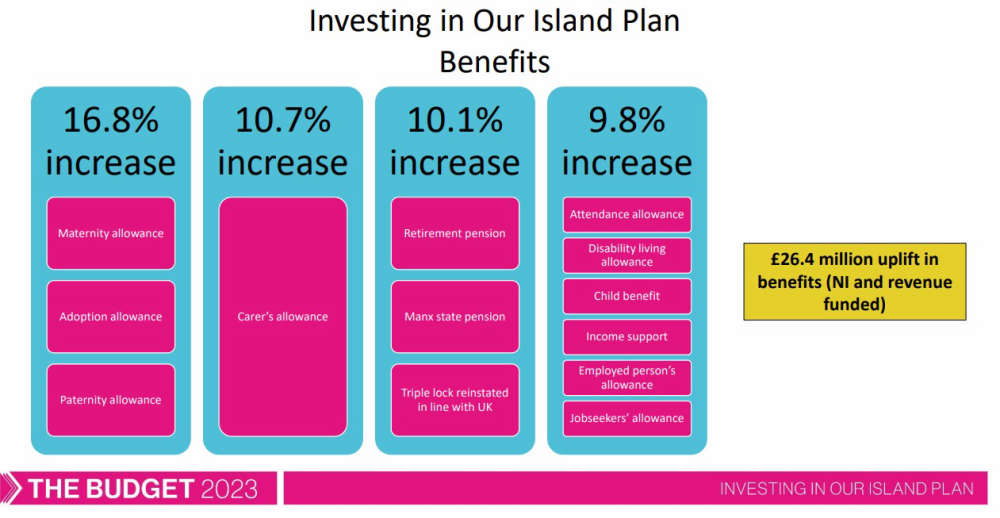

Key rises in the following benefits:

-

Pensioners

-

-

Following the restoration of the ‘triple lock’ uprating -

-

Basic state pension (10.1%)

-

Additional pension – ‘SERPS’ (10.1%)

-

Manx State Pension – up to full amount (10.1%)

-

Manx State Pension – protected amounts (10.1%)

-

-

-

Family/Other

-

-

Maternity allowance, adoption allowance and paternity allowance (16.8%)

-

Child Benefit (9.8%)

-

Employed Person’s Allowance – basic allowances and allowances for children (9.8%)

-

-

-

Disability

-

-

Carer’s Allowance (10.7%)

-

Attendance Allowance (9.8%)

-

Disability Living Allowance (9.8% generally, 10.1% for higher rate mobility component)

-

Income Support Carer Premium (17.1%)

-

Income Support Disability and Disabled Child Premiums (9.8%)

-

Nursing Care Contribution (10.1%)

-

-

-

The increase in Carer’s Allowance will benefit almost 600 carers.

-

Around 19,000 pensioners will see their State Pension increased by 10.1%.

-

Approximately 3,500 individuals and families of working age on low incomes will benefit from increases in Employed Person’s Allowance, Income Support and income-based Jobseeker’s Allowance.

-

Economic Strategy Fund established with funding of £100 million to support delivery of the Economic Strategy for the Island.

-

A five-year capital investment programme worth £442.4 million, with £233.5 million allocated to Central Government schemes.

-

The Healthcare Transformation Fund will be topped up by a further £3.5 million to support the ongoing implementation of recommendations from the Sir Jonathan Michael report.

Ballaugh Bridge now open following RTC

Ballaugh Bridge now open following RTC

Section of Mountain Rd now open with temporary 40mph speed limit

Section of Mountain Rd now open with temporary 40mph speed limit

RTC in area of Ballamodha

RTC in area of Ballamodha

Mountain Road closure reduced to section between Creg Ny Baa and Brandywell

Mountain Road closure reduced to section between Creg Ny Baa and Brandywell

Mayoral Appeal donates £3,000 to local causes

Mayoral Appeal donates £3,000 to local causes

Man who tried to steal clothes worth £660 appears in Court

Man who tried to steal clothes worth £660 appears in Court

Johnston says Tesco is continuing local charity support

Johnston says Tesco is continuing local charity support

Sock it to us, says vet!

Sock it to us, says vet!