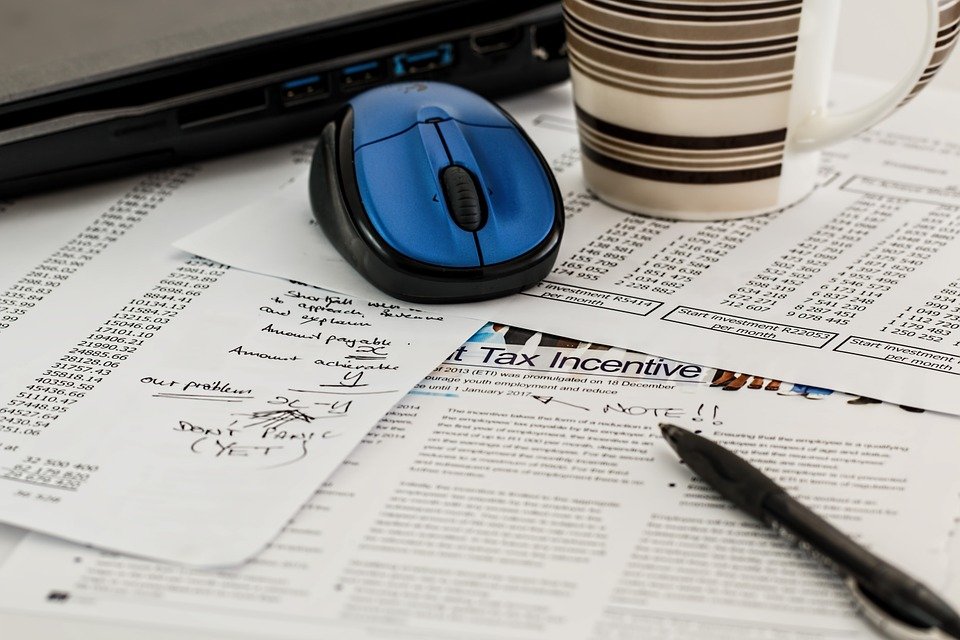

Residents and businesses will have to submit VAT returns make electronic payments online from April next year.

Government says from April 1, 2021, this will be mandatory - currently three-quarters of returns are submitted online using the Government's Online Services.

Customers who aren't currently enrolled for VAT Online Services will automatically receive a letter with an activation code with their next VAT return.

Speaking about the move, Treasury Minister, Alf Cannan MHK, says: "The changes being announced today represent the latest development in moving more Isle of Man Government services online.

"We acknowledge that some may receive this news with concern and questions, and full support is in place for those who need it."

Officials add the move is also so all customers are prepared for the future introduction of a new system with greater online functionality.

Those who're unable to render returns or make payments electronically - using, for example, Faster Payments, CHAPS, Bacs or card payment using Online Services-– can apply for an exemption.

Guidance can be found at gov.im/customs, under ‘Exemption from using VAT Online Services'; can be requested by calling 686 677; by emailing customsonline@gov.im or writing to Isle of Man Treasury, Customs & Excise Division, Customs House, North Quay, Douglas, IM99 1AG.

Drone show to round off Southern 100 tonight!

Drone show to round off Southern 100 tonight!

£869 limited-edition Joey Dunlop helmet almost gone

£869 limited-edition Joey Dunlop helmet almost gone

Tynwald to vote on extra £15 million for Manx Care

Tynwald to vote on extra £15 million for Manx Care

Jurby Road closed after crash

Jurby Road closed after crash

Government agencies' due diligence questioned

Government agencies' due diligence questioned

Man appeals against rape conviction

Man appeals against rape conviction

Ramsey hosts commissioners by-election hustings

Ramsey hosts commissioners by-election hustings

Weekend heatwave prompts dog warning from charity

Weekend heatwave prompts dog warning from charity