The Chamber of Commerce feel a landmark tax agreement between the Isle of Man and UK will do nothing to deter financial institutions coming to the Island.

The cooperation agreement is geared toward stamping out UK tax evaders.

Under the plans the Isle of Man will be expected to share a wide range of financial information on UK tax payers with accounts here, to HM Revenue and Customs.

Mike Hennessy of the Chamber of Commerce says it’s a positive move, as those set to suffer under the agreement are not the types of clients the Island wants to attract anyway:

(AUDIO ABOVE)

Four more ferry crossings affected by weather

Four more ferry crossings affected by weather

Bottleneck car park closes in face of weather

Bottleneck car park closes in face of weather

Weather warning issued for high tides tomorrow

Weather warning issued for high tides tomorrow

Two more ferry crossings called off

Two more ferry crossings called off

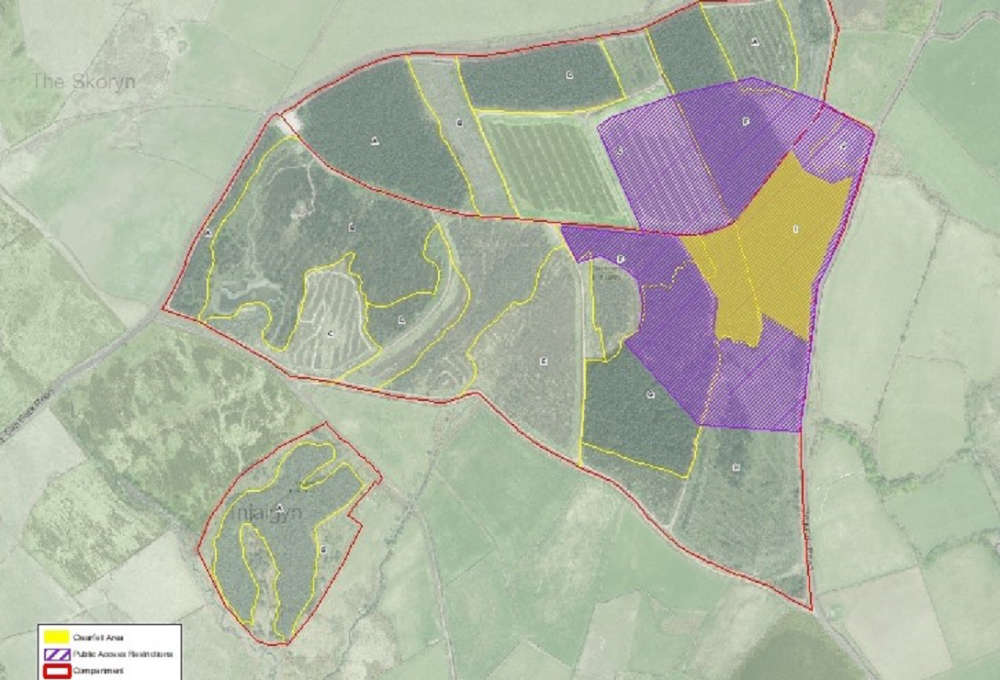

Plantation to close for tree felling work

Plantation to close for tree felling work

Thomas the Ramsey Cat supporting two charities this year

Thomas the Ramsey Cat supporting two charities this year

Waves blast out Sea Terminal glass barriers

Waves blast out Sea Terminal glass barriers

Southern local authority announces below-inflation rates rise

Southern local authority announces below-inflation rates rise