The chair of Braddan Commissioners has rejected the claim that business rates income in the parish ‘artificially lowers’ costs for domestic ratepayers.

Andrew Jessopp says unlike others, his local authority chooses to provide a high-level of services in Braddan, and aims to ‘make up for a lack of central government investment’.

A number of questions on changing the collection of business rates have been posed in a consultation launched by Policy and Reform Minister Chris Thomas in February.

It’s asked whether it is ‘fair that some rating authorities use business rates to subsidise domestic rates’, and whether an ‘all-island’ business rate should be introduced.

Areas such as Bride, Braddan and Malew benefit from a greater number of non-domestic payers like the airport, industrial estates, and the energy from waste plant.

Government claims the consultation is based on ‘spreading the burden of rates more fairly’ across the Island, not on raising additional funds.

Rates in Braddan will be set at 201p in the pound from April for the some 1,350 households in the parish.

Mr Jessop says picking on Bride, Braddan and Malew masks fundamental problems in taxation at both local and central government level.

He’s convinced if an all-Island business rate is introduced, much of the funding will be siphoned off to ‘plug the pensions blackhole’ and other government debts.

Two more schemes backed by government fund

Two more schemes backed by government fund

Island to get Bikesafe scheme for first time

Island to get Bikesafe scheme for first time

Jurby Junk's Stella dies aged 90

Jurby Junk's Stella dies aged 90

No plans to publish UK's assisted dying letters

No plans to publish UK's assisted dying letters

Burst water main disrupts Onchan supply

Burst water main disrupts Onchan supply

Government advice following spike in data breaches

Government advice following spike in data breaches

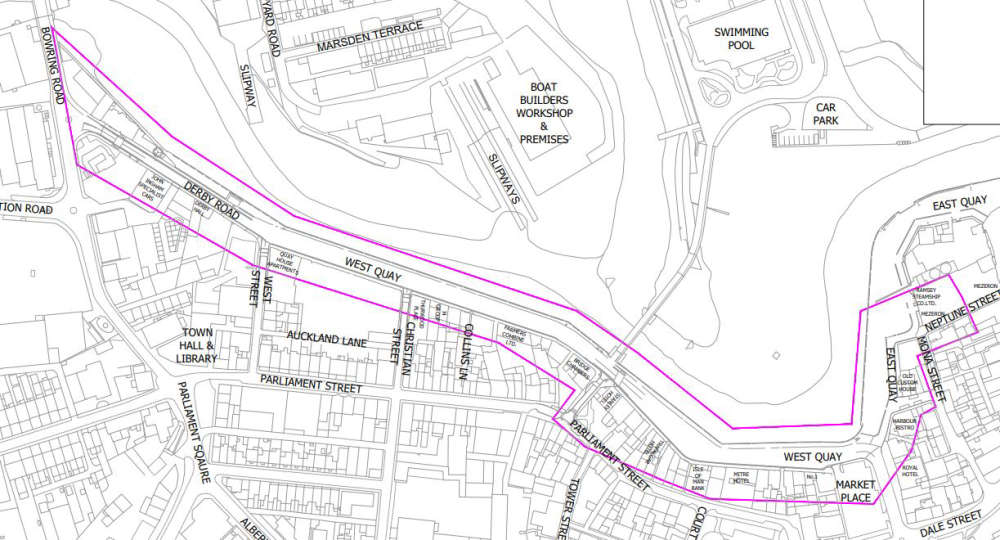

Plans for four-foot flood walls at Ramsey harbour

Plans for four-foot flood walls at Ramsey harbour

Garage blaze in the early hours of this morning

Garage blaze in the early hours of this morning