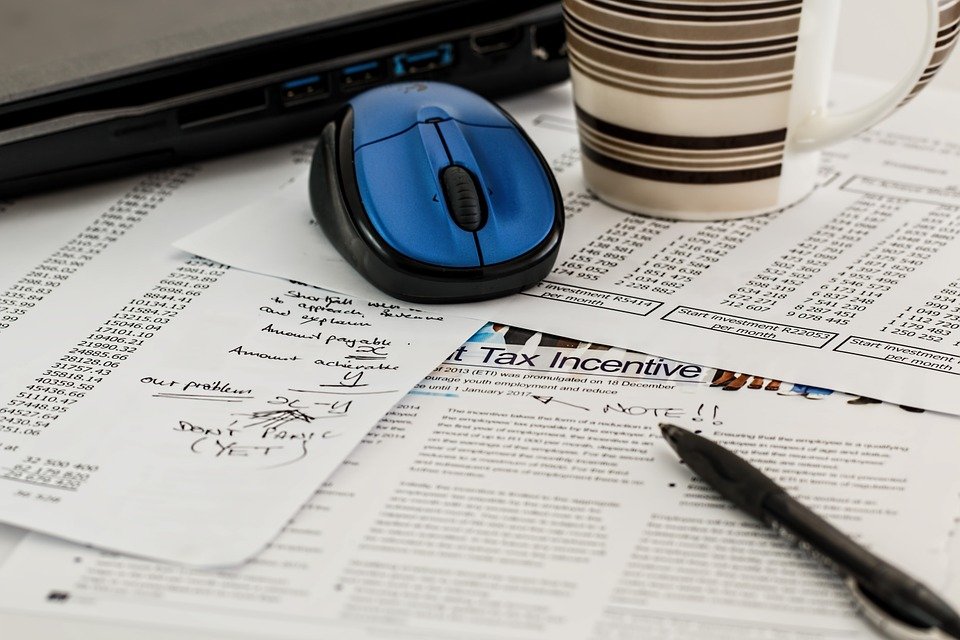

Residents and businesses will have to submit VAT returns make electronic payments online from April next year.

Government says from April 1, 2021, this will be mandatory - currently three-quarters of returns are submitted online using the Government's Online Services.

Customers who aren't currently enrolled for VAT Online Services will automatically receive a letter with an activation code with their next VAT return.

Speaking about the move, Treasury Minister, Alf Cannan MHK, says: "The changes being announced today represent the latest development in moving more Isle of Man Government services online.

"We acknowledge that some may receive this news with concern and questions, and full support is in place for those who need it."

Officials add the move is also so all customers are prepared for the future introduction of a new system with greater online functionality.

Those who're unable to render returns or make payments electronically - using, for example, Faster Payments, CHAPS, Bacs or card payment using Online Services-– can apply for an exemption.

Guidance can be found at gov.im/customs, under ‘Exemption from using VAT Online Services'; can be requested by calling 686 677; by emailing customsonline@gov.im or writing to Isle of Man Treasury, Customs & Excise Division, Customs House, North Quay, Douglas, IM99 1AG.

Stop putting knives in recycling, says council

Stop putting knives in recycling, says council

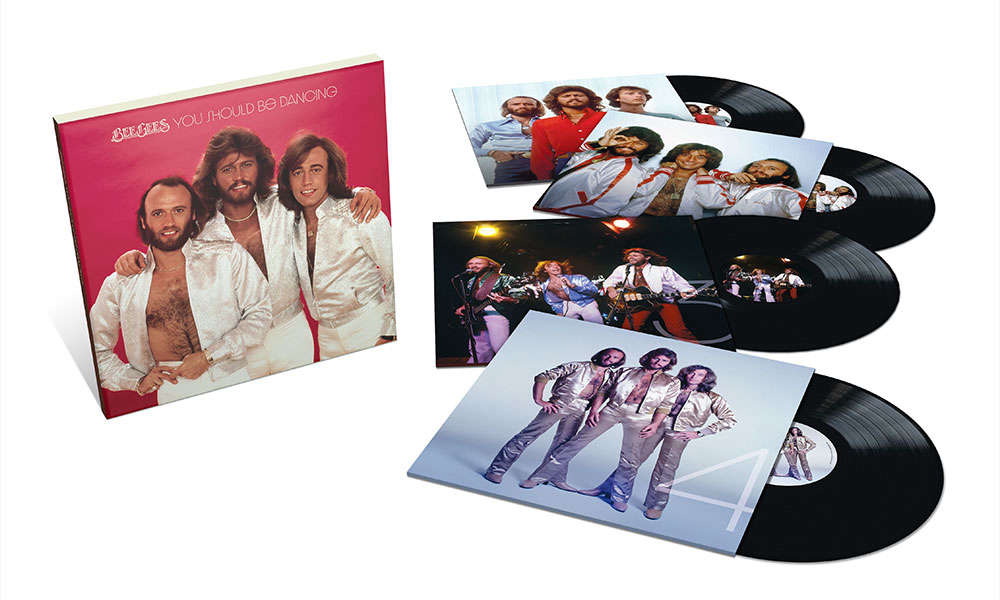

Bee Gees to release limited-edition box set

Bee Gees to release limited-edition box set

Northern Irish politician criticises Manx visa rules

Northern Irish politician criticises Manx visa rules

Elective surgical unit opens at hospital

Elective surgical unit opens at hospital

Piling rig on TT course tonight

Piling rig on TT course tonight

10-day bus strike from next weekend

10-day bus strike from next weekend

Yellow snow warning issued by forecasters

Yellow snow warning issued by forecasters

Ramsey harbour keeper completes 3,000-Mile Atlantic crossing

Ramsey harbour keeper completes 3,000-Mile Atlantic crossing