2015-16 Budget breakdown – The 10 facts you need to know.

- Proposals to abolish the 10 percent tax band will benefit those earning below £14,000. Anyone earning above that figure will fall into the 20 percent taxation bracket. Under these proposals anyone earning £20,000 per year will incur an additional £150 tax charge – those earning between £14,000 and £18,500 will pay less tax than they are currently. If given approval this wouldn’t be implemented until next year.

- Income thresholds for means-tested child benefit will drop by £10,000. Families earning below £50,000 are entitled to full benefit, reduced benefit to those between £50,000 and £80,000, and those earning above £80,000 will no longer be entitled to claim benefit.

- The ‘tax cap’ on high earners has been increased to £125,000.

- Carer’s have seen a significant 82.7 percent allowance increase.

- From next year pensioners still in employment will have to pay National Insurance contributions.

- Employers will be able to benefit from a National Insurance ‘holiday’ scheme when taking on a person who has been long term unemployed, long term sick or recently released from prison.

- Loan interest will once again be charged to Departments, with the money raised going to replenish the Capital Fund.

- An additional £3 million has been ring fenced for the Town and Villages Regeneration fund.

- Personal tax credit has been reduced to £400 and is now restricted to the elderly or disabled, earning below £9,500.

- Companies will now have to pay 20 percent tax on income from local land and property.

Balladoole's re-use sheds on the agenda in Tynwald

Balladoole's re-use sheds on the agenda in Tynwald

Yellow weather warning issued over snow and ice tonight

Yellow weather warning issued over snow and ice tonight

Steam Packet carried 680,000 passengers last year

Steam Packet carried 680,000 passengers last year

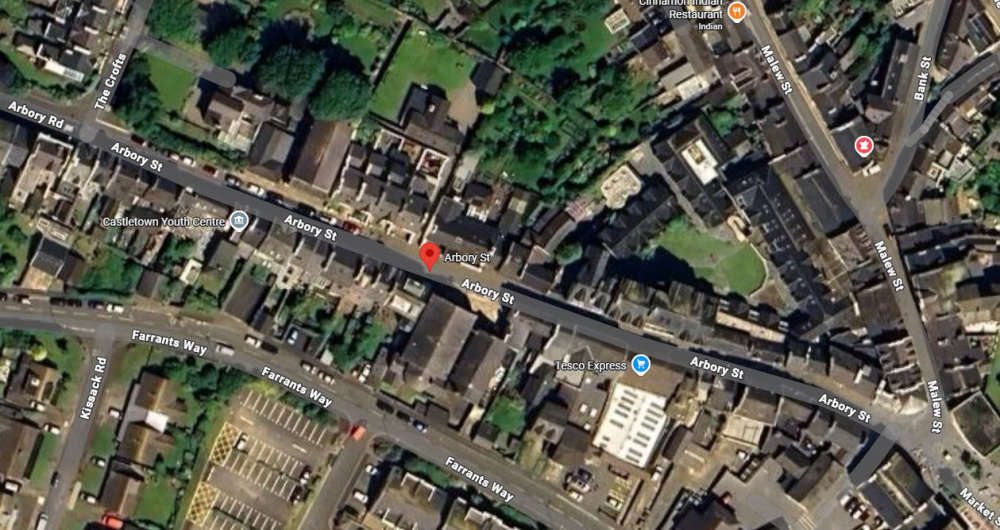

Roof work to shut Castletown shopping street

Roof work to shut Castletown shopping street

Church unveils plans to modernise facilities

Church unveils plans to modernise facilities

Are Mountain Road closures harming Ramsey?

Are Mountain Road closures harming Ramsey?

No whey! Creamery says goodbye to much-loved butter

No whey! Creamery says goodbye to much-loved butter

Roofing Outlaw plans Isle of Man franchise

Roofing Outlaw plans Isle of Man franchise