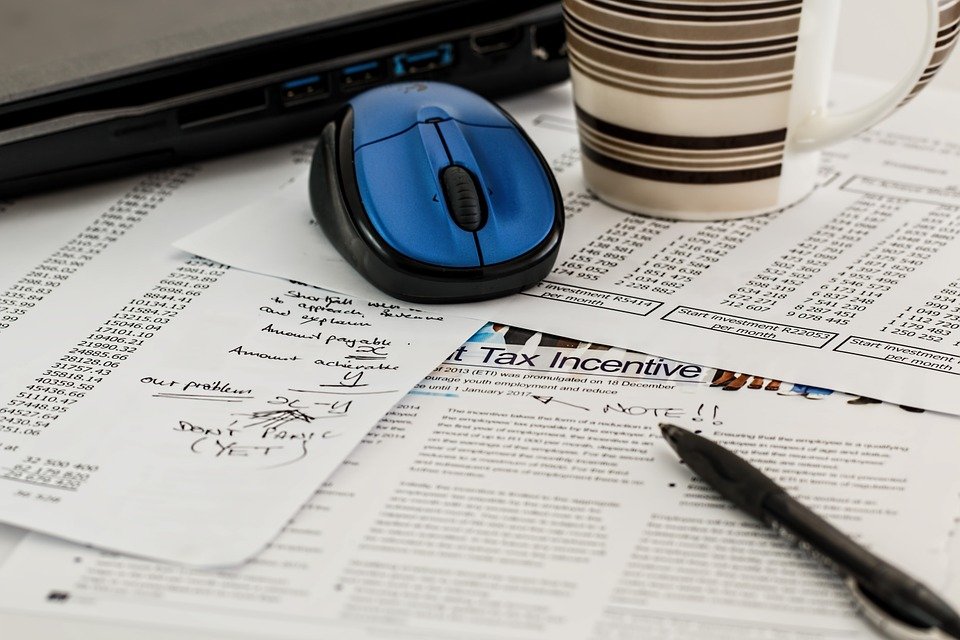

The deadline for submitting employer’s and contractor’s tax returns is now just a week away.

If the Income Tax Division hasn't received the tax returns for the year by May 5, people could face a £250 penalty.

Further, employers and contractors could face a charge of £50 per day for each day the return continues to remain outstanding.

Even if the penalties are paid, the tax returns must still be submitted and the employer or contractor may be prosecuted for failing to do so.

Anyone interested in doing so can register through www.gov.im/onlineservices.

Businesses invited to Southern Agricultural Show

Businesses invited to Southern Agricultural Show

New gym being launched in historic church

New gym being launched in historic church

Construction careers fair next month

Construction careers fair next month

Regulator asks businesses for info to fight financial crime

Regulator asks businesses for info to fight financial crime

Chamber of Commerce wants members for election task force

Chamber of Commerce wants members for election task force

Bank deposits rose over past year

Bank deposits rose over past year

Innovation and Investment forum expands to Island

Innovation and Investment forum expands to Island

Conister Bank boosts local charity with record donation

Conister Bank boosts local charity with record donation